Support Team

Feedback:

support@nextpcb.comThis article introduces the ranking of the world's top printed circuit board manufacturers released by NTI in 2019, and understands the scale of global and Chinese printed circuit companies. China's PCB manufacturing industry has a higher proportion of the world and has a bright future.

Every year, N.T.Information (NTI) publishes the list of the world's top printed circuit board (PCB) manufacturers. In 2019, the list of the world's top printed circuit board manufacturers (NTI100) is published on the PCD&F website. Now I have compiled its main content into Chinese, and added some of my views for reference by domestic colleagues to understand some industry information and development trends. The world's top PCB companies PCB production areas are located in many places around the world, and currencies around the world are different, so the output value is calculated in US dollars.

The annual sales of PCB manufacturers listed in the NTI-100 ranking table are more than 100 million US dollars. In order of PCB sales in 2019, the ranking of the world's top PCB manufacturers is shown in the table below. The author of NTI-100 stated that it is very difficult to collect information on PCB manufacturers. In addition to the public annual reports of listed companies, unlisted companies obtain it by contacting them. It is also speculated that the data of many Chinese manufacturers are from the top 100 published by CPCA. Extracted from the list. This ranking is a basic description of the world's top PCB manufacturers. Since the output value of PCB manufacturing and assembly operations in the same company is difficult to distinguish, the total income of 122 manufacturers in the following table also includes the PCB assembly (PCBA) value.

In the table, there are 49 companies with negative growth in 2019, accounting for 40.2%. It can be said that 2019 is not good; but in Table 2 as a whole, nearly 60% of the companies still have positive growth, and the overall situation is still good. Of the 52 Chinese companies listed in the table, only 10 companies have negative growth, accounting for less than 20%. China's PCB industry is still good. And the ranking of Chinese companies is moving forward. In 2019, the output of 122 companies worldwide (62.315 billion U.S. dollars) accounted for 82.1% of global output (75.894 billion U.S. dollars). It can be said that less than 10% of the manufacturers in the global PCB industry account for more than 80% of the output. The number of mainland Chinese companies on the list is increasing, and I believe they will account for more than 50% in a few years. Of course, the proportion of the total output value of mainland Chinese enterprises is not high, and it is also increasing compared with the previous year.

The proportion of Taiwan, China is also growing, and it is in the forefront, occupying 5 of the top ten of NTI-100. The total output value of the top ten is 21.836 billion U.S. dollars, and the output value of five Taiwan-funded enterprises (11.526 billion U.S. dollars) accounts for 52.8%. In 2019, the total output of Taiwanese companies exceeded 22 billion U.S. dollars. Of course, 65% of the revenue of these companies came from production in mainland China, and Taiwan's PCB manufacturers continue to expand in the mainland.

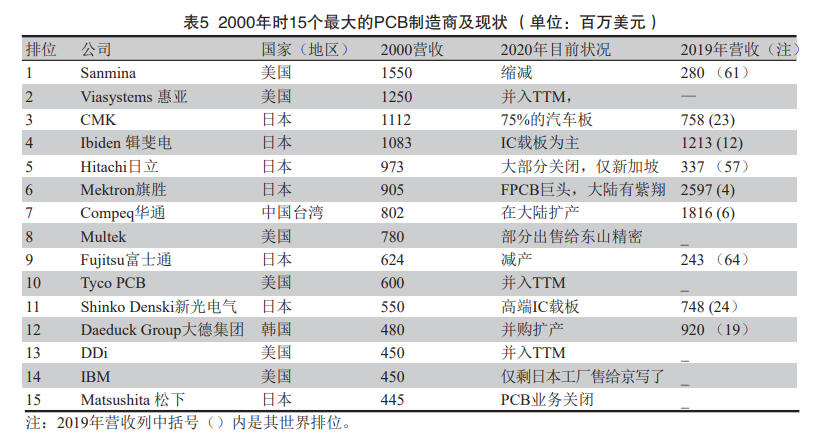

It has been 20 years from 2000 to 2019. Comparing the NTI-100 in 2000 and 2019, we can see the changes in the PCB industry. NTI selected the top 122 manufacturers from the 200 manufacturers in 2000 and compared it with the latest 2019 ranking. The situation is shown in the figure below. It can be seen from the figure that in the past two decades, the PCB manufacturing industry in Japan, the United States, and Europe has declined significantly, and the number of companies on the NTI-100 list and the proportion of output value have decreased significantly. In addition to China, Taiwan, China and South Korea also have significant growth. And South Korea has also gone downhill in the past two years. In 2000, only 6 of the world’s top 122 manufacturing companies were Chinese companies, including Hong Kong’s Elianta and Meiwei, among which there was only 1 Shantou Ultrasound (CCTC) in mainland China. In 2019, there are 52 Chinese companies. The number of NTI-100's world's top PCB companies and the proportion of their output value have increased nearly nine times in China in the past two decades! In the future, more Chinese manufacturers will enter the NTI-100 list. Look at the situation of the top 15 PCB manufacturers listed by NTI-100 in 2000, as shown in Table 5. In 2000, among these 15 companies, the United States and Japan were the main ones. Now only one in the United States retains its original name (Sanmina), but its ranking has dropped to 61st; Japan has 7 companies, and now Matsushita has stopped its PCB production activities. , And only 2 companies still remain in the top 15.

The top 15 PCB manufacturers in the world in 2000, with a total revenue of 12.144 billion US dollars; company distribution: 6 in the United States, 7 in Japan, 1 in Taiwan, and 1 in Korea The top 15 PCB manufacturers in the world in 2019, with a total revenue of 27.744 billion US dollars; company distribution: 1 in the United States, 2 in Japan, 6 in Taiwan, 3 in China, 2 in South Korea, and 1 in Europe. The scale and distribution of the PCB manufacturing industry in the past two decades has changed a lot. Global PCB production and trends

NTI believes that it is impossible to make a decent forecast of PCB production in 2020. According to NTI-100 in 2019 and the latest market production data, the global PCB output value is shown in the following table.

Chinese PCB manufacturers continue to invest heavily in the construction of new factories, and to develop into "smart factories", many of which are very large in scale. Although some people complain that this will cause overcapacity, it is still going on, and the purchase of PCBs is increasingly dependent on China. Taiwan PCB manufacturers also continue to expand in the mainland. Regardless, China's PCB production, including foreign manufacturers in China, will continue to grow. If you pay attention to PCB manufacturers that have shown significant gains from 2018 to 2019, you can see that these manufacturers are all engaged in 5G-related infrastructure PCBs, such as base stations, servers, routers, and switching networks. There are also a number of IC substrate manufacturers that benefit from high-end servers, computers, memory, etc., which are also related to 5G communications. PCB manufacturers that rely heavily on the automotive market did not perform well in 2019. During this year, as car sales fell sharply, although the number of electronic products in cars was increasing, the year was not easy. The auto market will fall by 20% in 2020.

In order to deal with this situation, they are trying to diversify the market, because relying on a small number of large customers in a certain market can sometimes grow rapidly, and it can also drop significantly. Currently, PCB manufacturers are facing polarization. Some did a good job, some did a poor job. Despite the emergence of a virus pandemic in 2020, through a detailed analysis of major PCB manufacturers, based on the performance and forecasts of the world's top PCB companies, it is believed that revenue in 2020 will still increase slightly.

Most of the electronic components related to PCB products are built around the support areas of downstream industries. At present, there are about 1,500 PCB companies in China located in areas where the electronics industry is highly concentrated, such as the Pearl River Delta, the Yangtze River Delta, and the Bohai Rim. They have a large demand for components. Such components are highly concentrated in Guangdong and Jiangsu provinces.

With the advent of the 5G commercial era, the construction of network infrastructure such as base stations is also accelerating, and 5G communication equipment has higher and higher requirements for communication materials, and the demand is also increasing. In the future, major operators will invest more in 5G construction. Therefore, the future communication PCB will have a huge market. It is estimated that by 2022, China's PCB output value will exceed 40 billion U.S. dollars, and by 2024, the output value will reach 43.8 billion U.S. dollars, and the market size has a lot of room for improvement.

With the continuous development of "Made in China 2025", it is emerging in emerging markets, such as mobile Internet, Internet of Things, big data, cloud computing, artificial intelligence and driverless cars. Many well-known local companies have emerged, and they have provided more development opportunities to support the electronics manufacturing industry.

Still, need help? Contact Us: support@nextpcb.com

Need a PCB or PCBA quote? Quote now

|

Dimensions: (mm) |

|

|

Quantity: (pcs) |

|

|

Layers: 2 |

Thickness: 1.6 mm |

|

|

|